Get This Report about Baron Tax & Accounting

Wiki Article

About Baron Tax & Accounting

Table of ContentsThe 10-Minute Rule for Baron Tax & AccountingBaron Tax & Accounting - The FactsNot known Details About Baron Tax & Accounting Fascination About Baron Tax & AccountingA Biased View of Baron Tax & Accounting

And also, bookkeepers are expected to have a good understanding of mathematics and have some experience in an administrative function. To come to be an accounting professional, you have to contend the very least a bachelor's degree or, for a higher level of authority and experience, you can become a public accountant. Accountants should also meet the strict needs of the accountancy code of technique.

The minimum qualification for the CPA and ICAA is a bachelor's degree in bookkeeping. This is a starting factor for further research study. This ensures Australian local business owner get the very best possible monetary suggestions and management feasible. Throughout this blog, we've highlighted the big distinctions between accountants and accountants, from training, to functions within your business.

Baron Tax & Accounting Things To Know Before You Get This

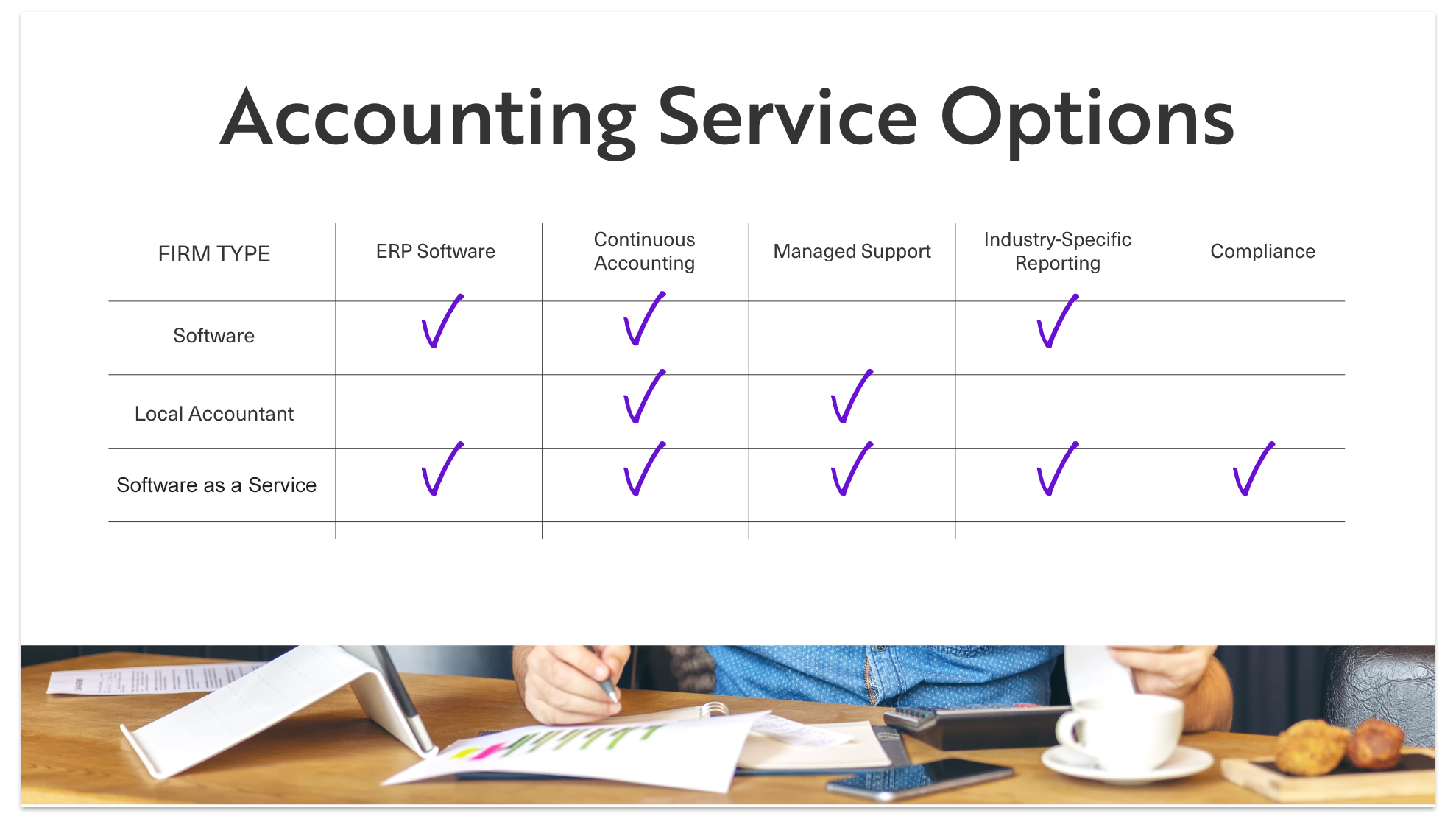

Bookkeeping companies do even more than simply accounting. The services they supply can make best use of revenues and support your funds. Organizations and people need to take into consideration accountants an important component of monetary planning. No accountancy firm provides every solution, so guarantee your consultants are best matched to your particular requirements (trusted online tax agent). Understanding where to begin is the initial difficultyAccounting professionals additionally can advise customers on making tax law benefit them. All taxpayers have the right to representation, according to the IRS. Accountancy companies can assist businesses represent their passions with consultation for filing treatments, information requests, and audits. The majority of firms don't function alone to accomplish these responses. They function alongside lawyers, monetary coordinators, and insurance specialists to create an approach to reduced taxi repayments and avoid pricey mistakes.

(https://soundcloud.com/baronaccounting)

Accounting professionals are there to calculate and update the set amount of cash every staff member receives routinely. Remember that vacations and illness influence payroll, so it's an element of the company that you must constantly upgrade. Retired life is also a considerable component of pay-roll management, especially offered that not every worker will want to be enrolled or be eligible for your company's retired life matching.

Some Of Baron Tax & Accounting

Some lending institutions and capitalists require decisive, strategic decisions between the business and shareholders following the meeting. Accounting professionals can additionally be existing below to aid in the decision-making procedure. Prep work involves releasing the earnings, capital, and equity statements to assess your current right here economic standing and condition. It's simple to see how complicated bookkeeping can be by the number of skills and tasks called for in the duty.

Little businesses typically encounter distinct monetary obstacles, which is where accountants can offer invaluable support. Accounting professionals supply a range of solutions that help services remain on top of their funds and make informed decisions. individual tax refund Australia.

Accountants guarantee that workers are paid properly and on time. They compute payroll tax obligations, take care of withholdings, and make certain conformity with governmental regulations. Processing incomes Handling tax obligation filings and settlements Tracking worker benefits and deductions Preparing payroll reports Appropriate pay-roll administration protects against issues such as late payments, wrong tax filings, and non-compliance with labor regulations.

7 Simple Techniques For Baron Tax & Accounting

This step lessens the threat of errors and possible charges. Local business proprietors can rely upon their accounting professionals to take care of intricate tax obligation codes and regulations, making the filing procedure smoother and much more efficient. Tax preparation is another necessary solution provided by accounting professionals. Reliable tax preparation includes planning throughout the year to lessen tax obligations.

These solutions usually concentrate on service evaluation, budgeting and forecasting, and capital management. Accountants help small companies in identifying the worth of the business. They examine properties, responsibilities, revenue, and market conditions. Methods like,, and are used. Precise appraisal assists with marketing the business, securing car loans, or drawing in capitalists.

Guide business proprietors on best techniques. Audit support aids services go through audits efficiently and effectively. It decreases stress and anxiety and errors, making sure that services meet all needed regulations.

By setting sensible monetary targets, services can allot resources effectively. Accounting professionals overview in the execution of these strategies to ensure they line up with the organization's vision.

An Unbiased View of Baron Tax & Accounting

They assist in establishing up internal controls to avoid scams and errors. Additionally, accountants suggest on conformity with legal and regulative demands. They guarantee that services comply with tax laws and sector laws to stay clear of charges. Accountants also recommend insurance plan that use security versus possible risks, guaranteeing business is guarded versus unexpected events.These tools help tiny companies keep precise documents and simplify processes. It assists with invoicing, payroll, and tax obligation prep work. It uses lots of functions at no price and is ideal for start-ups and small organizations.

Report this wiki page